How the Dollar’s Decline and Gold’s Surge Are Shaping the Real Estate Market in 2025

How the Dollar’s Decline and Gold’s Surge Are Shaping the Real Estate Market in 2025

In recent weeks, the U.S. dollar has tumbled to a three-year low while gold prices have soared to unprecedented heights, breaking records above $3,400 per ounce. These dramatic shifts are not just headlines for financial markets—they are sending ripples through the real estate sector, influencing everything from construction costs to foreign investment and rental markets. Let’s explore how these macroeconomic forces are reshaping real estate in 2025.

The Dollar’s Decline: What’s Happening?

The dollar’s sharp drop stems from a combination of political tensions, trade disputes, and concerns over the Federal Reserve’s independence. President Trump’s public conflict with Fed Chair Jerome Powell and the imposition of sweeping tariffs have shaken investor confidence, weakening the greenback against major currencies like the euro, yen, and Swiss franc.

Gold’s Record-Breaking Rally

As the dollar weakens, investors are flocking to gold, traditionally a safe haven during times of uncertainty. Gold’s rapid ascent to over $3,400 per ounce reflects growing fears of inflation, currency devaluation, and global economic instability. This surge highlights a broader risk-off sentiment in the markets.

What Does This Mean for Real Estate?

How the Dollar’s Decline and Gold’s Surge Are Impacting Real Estate in 2025

Introduction

Keywords to target: U.S. dollar decline, gold price surge, real estate market 2025, impact on housing, foreign investment real estate

The U.S. dollar has recently fallen to a three-year low, while gold prices have soared past $3,400 per ounce, setting new records. These significant financial shifts are not just affecting investors—they’re reshaping the real estate market in 2025. From rising construction costs to increased foreign investment, here’s what buyers, sellers, and investors need to know.

Why Is the U.S. Dollar Declining?

Keywords: dollar weakness 2025, Federal Reserve independence, Trump tariffs impact

The dollar’s decline is driven by political uncertainty, trade tensions, and concerns about the Federal Reserve’s independence. President Trump’s public disputes with Fed Chair Jerome Powell, combined with sweeping tariffs, have undermined confidence in the dollar, leading to its depreciation against major currencies like the euro and yen.

Gold’s Historic Rally and What It Means

Keywords: gold price record, safe haven assets, inflation hedge gold

As the dollar weakens, gold has surged to historic highs, reflecting investor fears about inflation and economic instability. This rally underscores gold’s role as a safe haven asset during times of uncertainty and currency volatility.

Real Estate Market Impacts in 2025

Rising Construction Costs

Keywords: construction costs increase, tariffs on building materials, housing development slowdown

Tariffs on imported materials such as steel and lumber, combined with a weaker dollar, have raised construction costs by over 30% since 2020. This increase is slowing new housing development and pushing home prices higher.

Mortgage Rates and Affordability

Keywords: mortgage rates 2025, home affordability, Fed interest rate outlook

Mortgage rates remain high but may ease as the Fed responds to economic pressures. Buyers should watch rates closely, as affordability remains a key concern amid rising home prices.

Surge in Foreign Investment

Keywords: foreign investment real estate, dollar weakness impact, international buyers US property

A weaker dollar boosts foreign buyers’ purchasing power, increasing demand in major U.S. real estate markets. This trend can drive up prices, especially in luxury and commercial sectors.

Rental Market Tightening

Keywords: rental market 2025, rent increases, landlord costs

Higher construction costs and increased demand are tightening rental markets, leading to rising rents and affordability challenges for tenants.

Market Uncertainty and Investment Sentiment

Keywords: real estate investment risk, Fed political pressure, market volatility

Political tensions affecting the Fed and the dollar create uncertainty that may slow investment and lending activity, though some investors see real estate as a stable asset amid volatility.

Tips for Navigating the 2025 Real Estate Market

Keywords: real estate tips 2025, home buying advice, real estate investing strategies

- For Buyers: Consider locking in mortgage rates early and explore emerging markets with less foreign competition.

- For Sellers: Leverage strong demand but stay alert to interest rate changes.

- For Investors: Diversify holdings and focus on properties with stable rental demand or foreign investor appeal.

- For Developers: Account for rising material costs and supply chain issues in project budgets.

Conclusion

The dollar’s decline and gold’s surge are reshaping real estate in complex ways. By staying informed and adapting strategies, market participants can turn challenges into opportunities in 2025.

Tariffs on imported materials such as steel, lumber, and appliances, combined with a weaker dollar, have pushed up the cost of building homes and commercial properties. Since 2020, material costs have jumped by over 30%, making new construction more expensive and potentially slowing the pace of housing development. For buyers, this could mean fewer new homes and upward pressure on prices.

2. Mortgage Rates and Buyer Affordability

While mortgage rates have been elevated, there are early signs they might ease as the Federal Reserve navigates this turbulent environment. Lower rates could improve affordability, but ongoing economic uncertainty and inflation risks may keep borrowing costs relatively high in the short term.

3. Increased Foreign Investment

A weaker dollar makes U.S. real estate more attractive to foreign investors, who gain greater purchasing power. This influx can boost demand in key markets, from luxury condos in major cities to commercial properties in growing regions. However, it may also contribute to price increases, especially in popular investment destinations.

4. Rental Market Tightening

Higher construction costs and increased demand from both domestic renters and foreign investors can tighten rental markets, pushing rents upward. Landlords may pass on higher expenses to tenants, intensifying affordability challenges for renters.

5. Market Uncertainty and Investment Caution

The political standoff impacting the Fed and the dollar introduces uncertainty that could make lenders and investors more cautious. While some investors see real estate as a safe haven amid stock market volatility, others may delay decisions until the economic outlook clarifies.

Navigating the Real Estate Landscape in 2025

For buyers, sellers, and investors, understanding these macroeconomic trends is crucial. Rising costs and shifting demand dynamics require careful planning and flexibility. Here are a few tips to navigate this environment:

- Buyers: Monitor mortgage rates closely and consider locking in rates when favorable. Explore markets with strong fundamentals but less foreign investor competition.

- Sellers: Take advantage of high demand and limited inventory but be mindful of potential shifts if interest rates rise.

- Investors: Diversify portfolios and consider real estate segments that benefit from foreign investment or stable rental demand.

- Developers: Factor in increased material costs and supply chain challenges when planning projects to maintain profitability.

Final Thoughts

The interplay between the dollar’s decline, gold’s surge, and trade tensions is creating a complex but dynamic real estate market in 2025. While challenges like rising costs and uncertainty persist, opportunities remain for those who stay informed and adapt strategically. Real estate continues to be a cornerstone of wealth preservation and growth—especially in times of economic flux.

Categories

Recent Posts

Top Real Estate Investment Tips for Irvine in 2025: A Guide for Chinese Investors

How to Choose the Perfect Irvine Neighborhood for Your Chinese Family in 2025

First-Time Chinese Homebuyers in Irvine: Navigating the 2025 Market with Confidence

Top 7 Family-Friendly Amenities in Irvine That Chinese Buyers Love in 2025

John Wayne Airport on Track for Over $700 Million in Improvements: What Travelers and the Community Can Expect

Summer Home Buying Tips for Chinese Buyers in Orange County

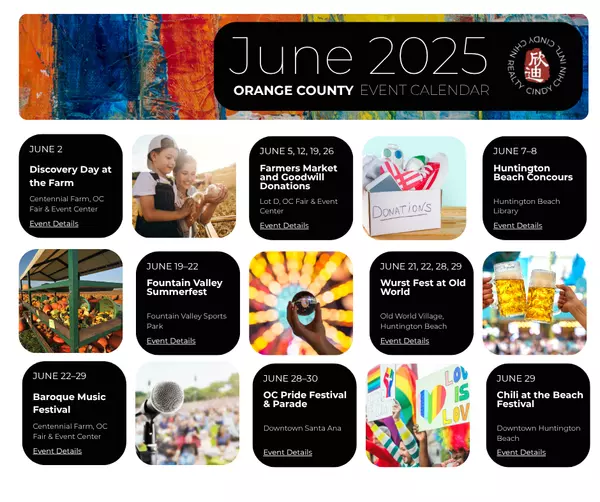

June 2025 Orange County Events

The Secret to Selling Fast in a Chinese-Dominated Markets

Irvine Housing Market Update 2025

Feng Shui Tips for Selling Your Irvine Home

GET MORE INFORMATION

Follow Us